Types of Digital Financial Services

Read this article to find out about the different types of digital financial services that you can access and enjoy through various financial apps.

-

Wais sa Home

Wais sa Home

-

Published August 19

Published August 19

Table Of Contents

To address the ever-changing needs of customers – especially during this time when safety of transactions is considered as the top priority – many businesses, including traditional banks and other financial institutions, had to adapt and speed up their digital transformation. This resulted in the rise of financial services that are accessed and delivered through digital channels, such as the internet, mobile phones or smartphones, and tablets, among others. Although many of these digital financial services have been existing for quite some time now, its usage has become more important than ever.

Assuming that you are already equipped with the knowledge and tools needed to navigate in the new normal, let’s now proceed to discussing the different types of digital financial services that you can access and enjoy through various financial apps.

Mobile Banking

Why physically go to a bank when you can make the same bank transactions in just a few taps on your mobile phones?

Why physically go to a bank when you can make the same bank transactions in just a few taps on your mobile phones?

Many, if not all, traditional banks in the Philippines have already launched their own mobile banking apps. In fact, banks have been putting a lot of thought and effort into their mobile apps – continuously upgrading both banking and security features and ensuring a seamless mobile banking experience for customers.

Through mobile banking, customers get easy yet secure access to their bank accounts right from their smartphones. They can now transfer funds, check account balances and transactions, pay bills, and deposit checks, among others, just by downloading their bank’s mobile app.

Of course, these features would depend on the bank, as larger banks usually offer more features compared to smaller banks. What’s common in all mobile banking apps is the time and effort they save compared to going to a physical bank.

Some of the popular mobile banking apps are BPI Mobile, BDO Digital Banking, and Metrobank Mobile Banking.

Online Banking

Prefer using desktop devices over mobile phones? The difference between mobile banking and online banking all boils down to where consumers want to access financial services.

Prefer using desktop devices over mobile phones? The difference between mobile banking and online banking all boils down to where consumers want to access financial services.

Online banking is the best option for customers who like transacting via desktop devices. Also known as internet banking, electronic banking or e-banking, this refers to any financial transaction performed using the internet through a bank’s website on a desktop computer or laptop.

How to Register for Online and Mobile Banking

In order to start using both online and mobile banking services, customers would need to enroll their existing bank accounts online. Customers are usually required to provide their bank account number, along with other basic information (e.g. full name, complete address, email, contact number, birthday, etc.) and create a username and password.

In order to start using both online and mobile banking services, customers would need to enroll their existing bank accounts online. Customers are usually required to provide their bank account number, along with other basic information (e.g. full name, complete address, email, contact number, birthday, etc.) and create a username and password.

Some banks even require ATM activation. Take BDO Online Banking for example. Their customers would need to fill out and submit an online enrollment form, take note of an ATM Activation Code, and have their accounts activated at any BDO ATM within a certain period.

Again, the registration or enrollment process is different for every bank, so make sure to check your bank’s website for more details or call their customer service for inquiries or other concerns.

Digital Banks

You might be wondering – isn’t digital banking the same as online banking? The simple answer to that is no. And here’s why: traditional banks build on their existing banking relationship with customers, providing online banking services to those who already have a bank account with them. This means you would still need to go to a physical branch to open an account, deposit cash and checks, withdraw cash, and make transactions involving large amounts of money.

You might be wondering – isn’t digital banking the same as online banking? The simple answer to that is no. And here’s why: traditional banks build on their existing banking relationship with customers, providing online banking services to those who already have a bank account with them. This means you would still need to go to a physical branch to open an account, deposit cash and checks, withdraw cash, and make transactions involving large amounts of money.

But with digital banks, banking services can be easily accessed through a mobile app. Not only can you do balance checks, money transfer, and bills payment in an app, but it also allows you to open a new account and deposit money by taking a photo of your checks. In fact, all their banking processes are automated, including customer service – making its transactions paperless and contactless.

Since digital banks do not have physical branches, they also get to reduce their operational costs. This is mainly why digital banks are known to have higher interest rates for their savings accounts compared to those of traditional banks.

However, being fully digital still has its limitations. You can’t really open joint or checking accounts, and having no physical locations meant that cash deposits and withdrawals still need to be done through another bank or performed over-the-counter in any of the digital bank’s partners outlets. This can be considered a trade-off for not having transaction fees, an initial deposit, and maintaining balance.

Whichever way you look at it, digital banks are a convenient option for those who want to access banking services at their fingertips.

Among the known digital banks in the country are ING Philippines, CIMB Bank, and Tonik Bank. A few traditional banks have also branched out to having their own digital banks, such as EastWest Bank with KOMO and RCBC with DiskarTech.

How to Open an Account in a Digital Bank

The process of opening an e-wallet account is simple and straightforward. All you need to do is have an active mobile number and follow these easy steps (Take note that these steps may vary and may be interchangeable depending on the e-wallet):

The process of opening an e-wallet account is simple and straightforward. All you need to do is have an active mobile number and follow these easy steps (Take note that these steps may vary and may be interchangeable depending on the e-wallet):

1. Open the digital banking app

2. Tap on the Sign Up or Create an Account button

3. Fill in the sign up details (full name, mother’s maiden name, complete address, mobi- le number, email, username). Some banks also ask for your place of birth, work and tax information, and other details that would support your application.

4. A One-Time Password (OTP) will then be sent to your mobile number. Once received, immediately type it in the app.

5. Create a password or passcode

6. Verify your identity by uploading a photo of your valid ID and proof of address (if needed), and taking a selfie on the spot. Some digital banks would also require you to take a photo of your signature on a piece of paper.

7. After submitting your application, wait for a message confirming the creation of your account. This may take a few hours to a few days, depending on the bank. If your application has been rejected, you will be advised as well. You may also be re quired to have your account verified via email.

8. Once approved, you can now start funding your digital banking account.

E-Wallet

In recent times, mobile wallets or e-wallets have been making waves in both the finance and retail industries for being a safer and more convenient alternative to paper transactions.

In recent times, mobile wallets or e-wallets have been making waves in both the finance and retail industries for being a safer and more convenient alternative to paper transactions.

Through e-wallets, you can receive, store, and spend money using just your mobile phones. But in order to do so, you would need to fund your e-wallet first. Most e-wallets offer multiple cash-in options, such as via online banking, debit/credit card, and over the counter (convenient stores, department stores, payment facilities, remittance centers, self-service kiosks, etc.).

Once your e-wallet has been funded, you can now use your mobile money to pay for your online and in-store purchases, make transfers to different e-wallets or banks, buy load, and pay bills, among others.

However, always take note that not all stores have e-wallet payment options. You can only use this payment method within your e-wallet’s list of partner merchants, as they would usually have a dedicated Quick Response (QR) code for you to scan when making purchases.

Primary examples of e-wallets in the country are GCash and PayMaya.

How to Create an E-Wallet Account

When it comes to opening a digital bank account, the requirements vary from bank to bank. Some require less documents (only 1 valid ID), while others require more (1 valid ID and proof of address, such as utility bills, credit card or bank statements, etc.). Whichever digital bank you decide to open an account with, make sure to prepare these documents, just in case they are needed. Now, for your account opening, most digital banks follow a similar process to this:

- Launch your e-wallet app and input your current mobile number

- Upon receiving the authentication or verification text, enter the code on your app

- Proceed to answering the required fields with your persona; information and make sure to review your answers before submitting

- Set and confirm your PIN or passcode

- You can now log into your e-wallet account

Once you’ve created an account, your registered mobile number will be your e-wallet’s account number.

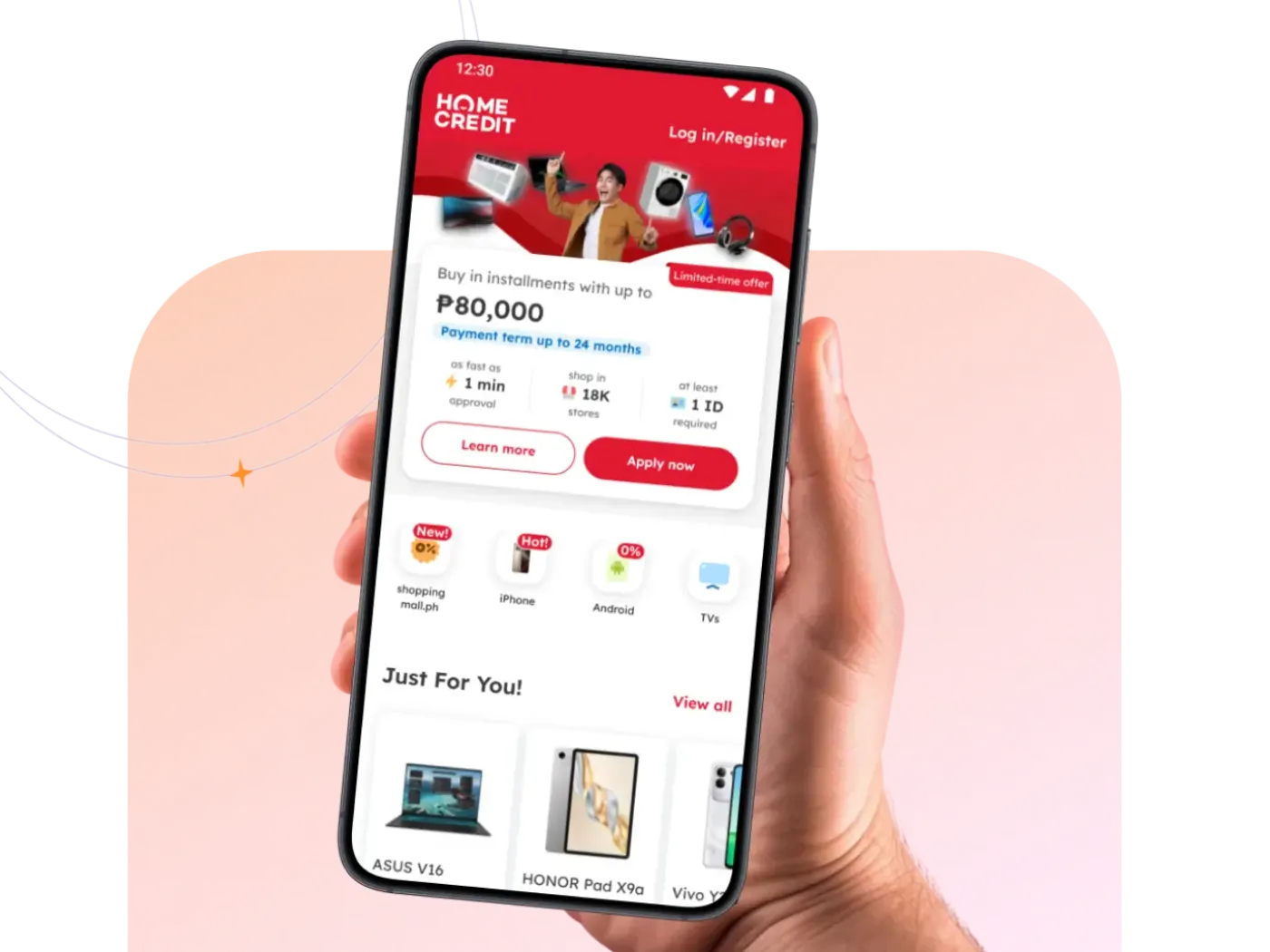

Loan and Consumer Finance Apps

In need of extra cash? The good news is, you can now easily apply for loans through your smartphones. Thanks to the development of loan and consumer finance apps, what used to be a complicated and time-consuming process has now become simpler and more convenient than ever.

In need of extra cash? The good news is, you can now easily apply for loans through your smartphones. Thanks to the development of loan and consumer finance apps, what used to be a complicated and time-consuming process has now become simpler and more convenient than ever.

Yes, you read that right – no more long queues, lengthy paperwork, and hours of waiting for a loan decision. In fact, most loan and consumer finance apps would only require around two (2) valid IDs and would have a loan decision in a matter of minutes.

And because of the increasing demand for digital financial services, these apps have expanded its offerings to more than just loans. A good example would be the My Home Credit app, which allows its users to pay bills, buy load, avail of discounts, and shop at their very own online marketplace. Their credit card holders can even pay for their purchases via QR code.

How to Set Up a Loan App Account

How to Set Up a Loan App Account

When it comes to setting up your own account in loan and consumer finance apps, the steps and requirements may vary. So for easier reference, let’s continue using the My Home Credit app as an example. is:

To open a My Home Credit account, just follow these four easy steps:

1. Provide your personal information (full name, mother’s maiden name, birthday, sex, and mobile number) in the required fields

2. After submitting, a verification code will be sent to your mobile number via SMS. Input the verification code in the app upon receipt.

3. Take a selfie photo for further verification

4. Finally, set a PIN. Remember this PIN, as it will be asked every time you log in to the app.

Although they may seem overwhelming at first, digital financial services can truly be game-changers when used to their fullest potential. More importantly, not only do these services make our lives easier, but they also provide opportunities for greater financial inclusion due to their convenience and accessibility.

Wais sa Home

Published August 19

Why physically go to a bank when you can make the same bank transactions in just a few taps on your mobile phones?

Why physically go to a bank when you can make the same bank transactions in just a few taps on your mobile phones? Prefer using desktop devices over mobile phones? The difference between mobile banking and online banking all boils down to where consumers want to access financial services.

Prefer using desktop devices over mobile phones? The difference between mobile banking and online banking all boils down to where consumers want to access financial services. In order to start using both online and mobile banking services, customers would need to enroll their existing bank accounts online. Customers are usually required to provide their bank account number, along with other basic information (e.g. full name, complete address, email, contact number, birthday, etc.) and create a username and password.

In order to start using both online and mobile banking services, customers would need to enroll their existing bank accounts online. Customers are usually required to provide their bank account number, along with other basic information (e.g. full name, complete address, email, contact number, birthday, etc.) and create a username and password. You might be wondering – isn’t digital banking the same as online banking? The simple answer to that is no. And here’s why: traditional banks build on their existing banking relationship with customers, providing online banking services to those who already have a bank account with them. This means you would still need to go to a physical branch to open an account, deposit cash and checks, withdraw cash, and make transactions involving large amounts of money.

You might be wondering – isn’t digital banking the same as online banking? The simple answer to that is no. And here’s why: traditional banks build on their existing banking relationship with customers, providing online banking services to those who already have a bank account with them. This means you would still need to go to a physical branch to open an account, deposit cash and checks, withdraw cash, and make transactions involving large amounts of money. The process of opening an e-wallet account is simple and straightforward. All you need to do is have an active mobile number and follow these easy steps (Take note that these steps may vary and may be interchangeable depending on the e-wallet):

The process of opening an e-wallet account is simple and straightforward. All you need to do is have an active mobile number and follow these easy steps (Take note that these steps may vary and may be interchangeable depending on the e-wallet): In recent times, mobile wallets or e-wallets have been making waves in both the finance and retail industries for being a safer and more convenient alternative to paper transactions.

In recent times, mobile wallets or e-wallets have been making waves in both the finance and retail industries for being a safer and more convenient alternative to paper transactions. In need of extra cash? The good news is, you can now easily apply for loans through your smartphones. Thanks to the development of loan and consumer finance apps, what used to be a complicated and time-consuming process has now become simpler and more convenient than ever.

In need of extra cash? The good news is, you can now easily apply for loans through your smartphones. Thanks to the development of loan and consumer finance apps, what used to be a complicated and time-consuming process has now become simpler and more convenient than ever. How to Set Up a Loan App Account

How to Set Up a Loan App Account