Top Things You Can Do with Your Mobile Payment App

Bill payments, money transfers, balance inquiries and more are now available at your fingertips. In this article, know more about the features of your mobile app.

-

Wais sa Home

Wais sa Home

-

Published August 19

Published August 19

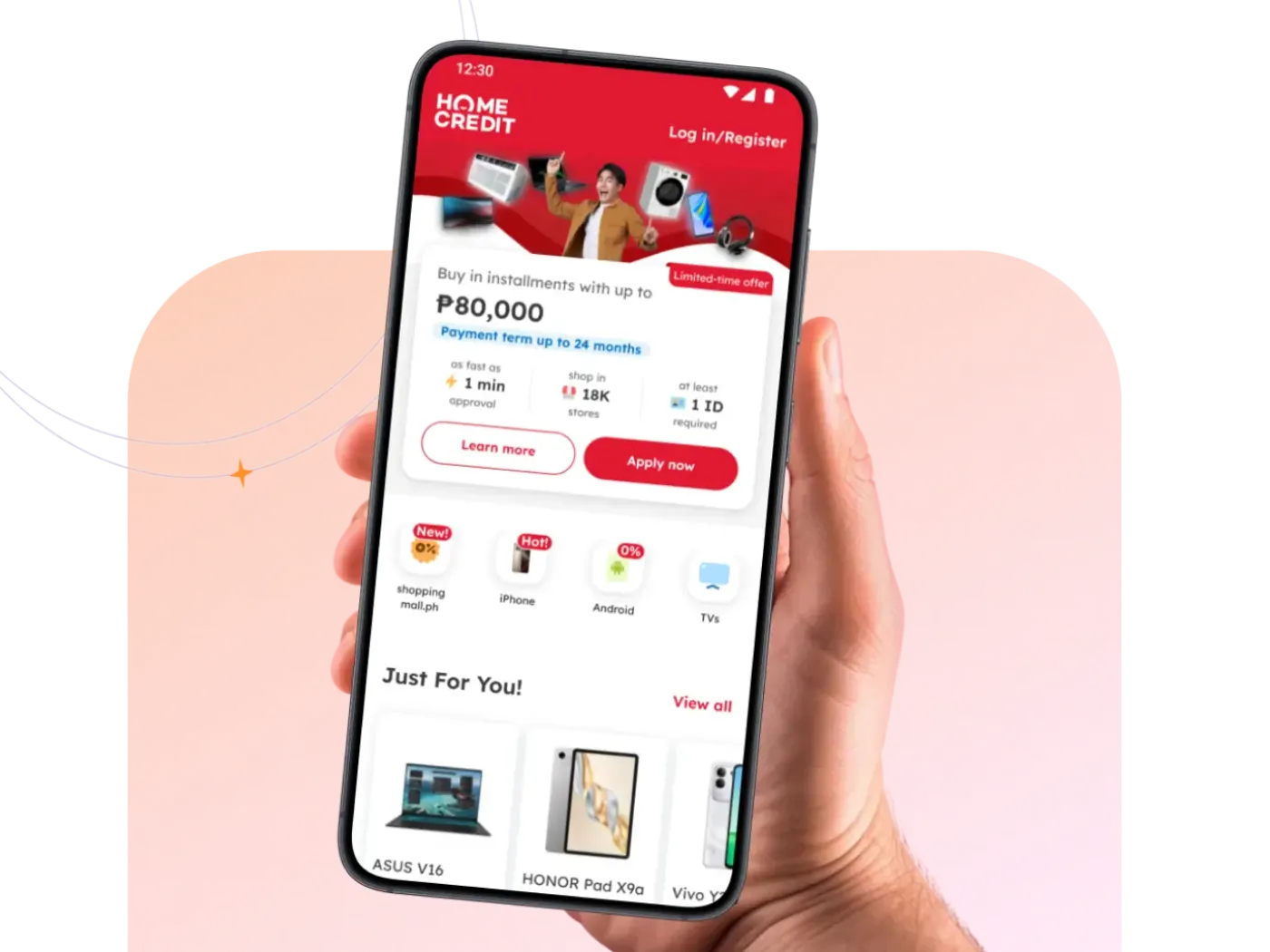

Doing your financial transactions is easier than ever before. With just a few clicks on your device, you can perform your usual rounds of sending money, paying bills, or even shopping without the need to go to any physical shop or establishment. That’s what digital payment platforms such as mobile apps bring to you – the convenience and safety of cashless and contactless payment that has become an essential in the new normal.

As we’ve addressed your hesitancy in using digital payment platforms by presenting you the different security features for a safe transaction online (link to ‘a convenient digital life’) and the different types of digital financial services and how you can access them, (link to ‘different types of digital financial services’), it’s time to cover the perks you can enjoy with mobile payment apps and the features you can use to get the most out of it:

PAY ONLINE

PAY ONLINE

Mobile apps providing online payment have finally entered the picture and there’s no denying that it’s here to stay. Using mobile e-wallets and mobile banking apps, we can make purchases online -just like swiping your credit or debit card – but without moving an inch.

The growing popularity of online shopping platforms have also propelled several financial providers to adapt to mobile payment methods. It’s as simple as enrolling your credit or debit card and providing your card number, expiry date and CVC/CVV number. Once you start shopping and making purchases, it will automatically be deducted from your bank account.

The same platforms have also started offering the e-wallet and top-up feature which you can use to fund with money from your bank account. Shopee, Lazada and Grab (to name a few) have in-app e-wallets that allow you to do just that and with exclusive promos like free shipping or discounts whenever you use it. Most apps also have the option for you to buy prepaid load with several of them providing cashbacks and rebates when you avail.

PAY ONLINE

PAY ONLINE

Because of the pandemic, we went from from ‘cash is king’ to ‘convenience is king’ in just a snap of a finger. Of course, paying our bills did not stop even during this time but our usual way of doing that has to change. Compared to the usual scenario of bills payment before where we need to wait and fall in line in the nearest payment kiosk, the emergence of online bills payment has attempted to erase that.

From being a payment center, Bayad now offers online bills payment for your monthly dues. Major banks through their mobile banking apps have also integrated payment options for your bills. If you don’t want to miss your monthly payment, you can set up an automatic bills payment to pay for ulitlity, telecommunication or internet bills. (Read: How to Set Up Automatic Bills Payment in your Debit/Credit Card)

FASTER WAY TO PAY

FASTER WAY TO PAY

The cashless trend in the new normal has given QR Code payments a push in the contactless ecosystem. It’s a payment method that lets customers scan a printed code using their mobile device’s camera that will automatically redirect them to the payment itself. Often placed at the counter or cashier area, it is com prised of black squares and bars on a white background. Due to its speed and simplicity, more and more retail shops are starting to use it.

In some consumer finance apps like Home Credit, you can conveniently pay for in-store transactions in their partner stores using QR and even earn a 1% rebate for every payment through their HCPay feature. In other apps, you can generate a QR code to either receive or send funds to or from your account.

Aside from QR Codes, other quick payment modes are also available to enable customers to pay instantly in just a few taps. One example are SMS payments wherein purchasers will send a text message to pay for an item or service. Once received by the mobile payment provider, the transaction between the vendor and the purchaser will be cleared.

Another one is payment links that you can click from an email, text message, social media, etc. in order to pay online. Other similar terms include pay by link, pay button or payment button which can vary depending on the payment provider.

They’re all easy and fast because you don’t need to use a card machine or enter bank details and card information. Using these methods, there’s no need to worry about loose change or carrying cash with you all the time.

.2024-05-07-09-26-09.png) OTHER SPECIAL FEATURES

OTHER SPECIAL FEATURES

To stand out from the others, some mobile payment apps built special features to provide a more seamless journey for their customers. A perfect example of that are chatbots. They provide a superb user experience for any query that needs prompt and immediate response. It’s like a messaging app inside your mobile payment app that allows you to ask questions or raise any concern that will be answered by automated replies.

Speaking of messaging, you can also receive announcements and updates from your provider via the built-in inbox within your mobile payment app. For special promos or important advisories, best to regularly check the inbox to be informed.

Some providers were also successful in incorporating their CSR (Corporate Social Responsibility) programs in their apps. GCash’s GForest for example, is a feature that ‘gives you the power to plant and grow real trees all within the GCash app’ through every successful cashless transaction that will earn you energy points.

When we say everything is in the palm of our hands, there’s a literal truth to that. With the things that we can do with our mobile devices especially through mobile payment apps – it’s no wonder we consider it as our new wallet and so much more. We hope that by sharing these amazing features available in the market, it will finally seal the deal and make you switch to the digital realm.

Wais sa Home

Published August 19

PAY ONLINE

PAY ONLINE PAY ONLINE

PAY ONLINE FASTER WAY TO PAY

FASTER WAY TO PAY.2024-05-07-09-26-09.png) OTHER SPECIAL FEATURES

OTHER SPECIAL FEATURES